Are markets efficient? Can active investors (stock pickers) consistently find stocks where value and price differ?

Proponents of market efficiency (i.e., academics) believe that any outperformance by active managers comes purely from luck. They recommend that the investor hold the market portfolio, instead of actively seeking undervalued stocks.

But evidence shows that seeking undervalued stocks works, both using aggregated and disaggregated data.

First evidence using aggregated data. Funds that invest in concentrated portfolios and/or deviate significantly from benchmarks tend to outperform, according to recent academic studies. For example, Marcin Kacperczyk, Clemens Sialm and Lu Zheng find that the more concentrated a fund was the better it did. The outperformance resulted from selecting the right sectors or stocks, not from market timing.

Martijn Cremers and Antti Petajisto show that those U.S. funds that deviated significantly from the benchmark portfolio outperformed their benchmarks both before and after expenses. And a study at UCLA co-written by Söhnke Bartram and Mark Grinblatt shows that “one can earn risk-adjusted returns of up to 9 per cent a year with rudimentary analysis of the most commonly reported accounting information. Such abnormal profits are a result of fundamental analysis and taking advantage of market inefficiencies.”

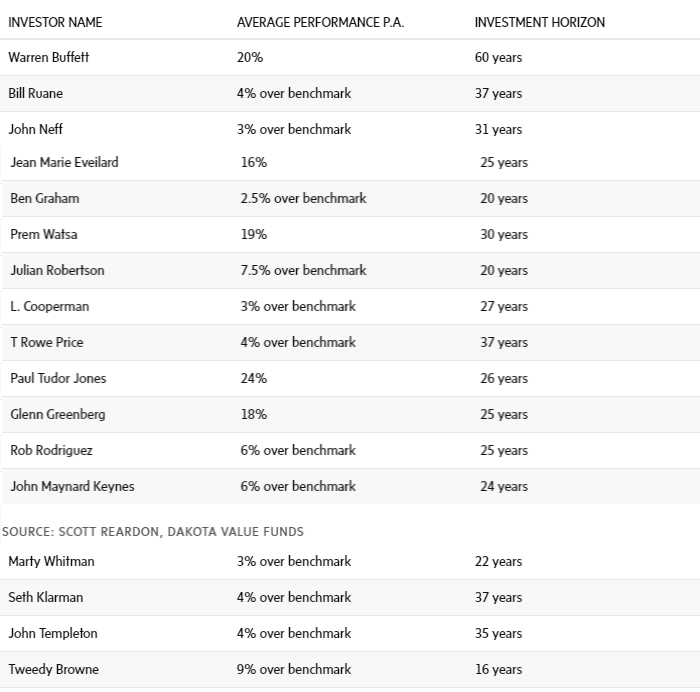

How about using disaggregated data? How have high-profile value investors faired over long periods of time. Academics have argued in recent papers that Warren Buffett has been lucky. But how about all the others who have followed the value-investing process? They cannot all be lucky.

And remember four things:

First, no one claimed that the value-investing decision process works all the time. It works, on average, in the long run.

Second, while recent U.S. studies showed that value investing was dead, this finding was the result of confusing value investing vs. the value-investing process.

The value-investing process involves three steps. Initially, value investors screen stocks and form portfolios based on a number of metrics such as P/E, P/B, market cap, etc. and focus on stocks in the lowest ranked portfolio. This allows them to identify stocks that have desirable characteristics (i.e., low price vs. fundamentals) and, at the same time, reduce the number of stocks they will consider in depth. The stocks selected from the initial step are now valued to determine their intrinsic value using both asset based and cash-flow-based valuation approaches. Finally, they make a decision to invest only in stocks that are truly undervalued, namely stocks that meet the required margin of safety.

Academics who showed that value investing was dead focused only on the initial step of the value-investing process, which includes all lowest P/E or P/B stocks. But a stock can have a low P/E or P/B simply because it is a bad stock. Value investors can still find undervalued stocks to invest in even if, on average, all low P/E or P/B stocks do not do well.

Are investment advisors worth it?

The third thing to remember, active managers have difficulty outperforming in a rapidly rising market. This is mostly because active managers hold large amounts of cash, especially as the market gets more and more expensive, which makes them underperform in a rapidly rising market. Whereas the index is always fully invested.

And fourth, the S&P 500, Nasdaq and other indexes are hard competitors to beat to start with. This is because normally (and regularly) problem companies are replaced in the index with companies with better financials and performance. In other words, active managers always compete with the best group of companies that the particular index contains. And active managers have to beat this “best-stocks” index after fees and after all other costs associated with running an active fund.

So, let’s be fair and give credit where credit is due and stop active-manager bashing. Skill does matter. Active management is not doomed. Good active managers will survive and will keep making a good living out of active management, especially in an environment of increased volatility in the months and years ahead.

Slow economic growth around the world, particularly in China, as well as a slowdown in productivity, lower population growth, aging baby boomers, higher taxes, higher inflation/interest rates and lower government spending will lead to an increase in stock-market volatility. An expensive market will also contribute to rising volatility, both realized and expected. In this environment, active managers, such as value investors, will shines, will shine.

First published September 8, 2023 / The Globe and Mail